12 Reasons Why People Do Not Get Wealthy

12 Reasons Why People Do not Get Wealthy

According to Wallace Wattles, in his popular wealth treatise called the Science of Getting Rich, said that,

"There is a science of getting rich, and it is an exact science, like algebra or arithmetic.

There are certain laws which govern the process of acquiring riches, and once these laws are learned and obeyed by anyone, that person will get rich with mathematical certainty."

It is true. Those who make wealth know that it comes about by application of simple rules and principles.

Those who don't make wealth don't know about these simple things, and so they assume that wealth is a result of luck or pure chance or something just as superstitious or silly.

Anthony Robbins is one of the top success coaches in the world, having coached star sports players, heads of states and Fortune 500 executives.

In his Get The Edge program, he listed down 12 specific reasons he has come to observe to be the leading causes for most people's lack of wealth.

Here they are:

1.

They never decide and really define, very specifically, what wealth means for them. The keyword here is specifically. Can you imagine how hard it would be to build a car or a plane without making a blueprint or sketch drawings of it first?

You have to know what your target is before you go chasing after it.

2.

They make wealth a moving target instead of a fixed one (this is related to point one above). Once you have your target, fix it.

Do not change it until you reach it. You must accomplish each step, celebrate, and then set course for a new step, a new target.

3.

They define it in a way that seems unreachable. You only achieve what you believe. No more, no less. So you must make it believable for you. Set goals that will make you move forward and stretch, but not too high that even you yourself don't believe you can. Take the biggest step you believe you can, achieve it, then take the next biggest you believe you can. This will build positive reinforcement in your self-confidence as well.

4.

They never start. Ok, this is obvious.

If you keep thinking about it forever, it will forever remain in the thought level.

You have to act!

Start somewhere, anywhere!

Only after you start do you begin to get some feedback, which will help you plot your course better. The aircraft has to first take off before it starts to adjust course for its destination.

You must start, somewhere, anywhere, doesn't matter, just start!

Act!

5.

They never make it a must. Let me explain what it means to make it a must. It means marshalling all your intent, your will, your direction, into one singular flow that is directed towards your goal. All obstacles are viewed as challenges to be overcome.

You will meet obstacles, and so expect it, but also expect to move forward anyways. Use your obstacles to develop strength and skills, don't run away.

Find out how to go past them.

Find out!

There is always a way, always. And if your emotions are acting against your desire, embrace them, learn what they are, know yourself, but keep moving forward. Make it a must, and it will happen. Guaranteed.

You do not know in how many steps it will take, but you know it will happen.

6.

They do not have a realistic plan. If you want to do something, find out how it is done from someone who has done it before. Make a realistic plan. Copy from those who have succeeded before you. But do not throw away your intuition.

Your intuition is extremely powerful once you learn how to listen to it with practice.

7.

If they have a realistic plan, they never follow through on the plan. Well, if you do not follow the plan, who will?

8.

They give responsibility to others ("experts") instead of to themselves. This way, they never really learn how to do it, and if there are failures they never learn why the failures happened and so they are bound to repeat them. It is a good idea to get advice, but do it yourself.

At least understand it yourself even if you will delegate the actual doing.

9.

They give up when they face challenges. Going through the challenges is what has made people rich, not giving up. Look, there are always challenges. So get used to that. You will only get where you wish to get to if you are willing to face the challenges along the path. All challenges are opportunities dressed in work clothes, remember that. After the challenge is over, you will discover the amazing fruit it held for you.

10.

They fail to conduct their lives as a business; they never ensure that they make a profit year by year. Get a personal finance package like Quicken or Microsoft Money. You need to have budgets and cash flow statements for your personal finances and your businesses.

It is easy with those software packages. If you do not keep records and track, you would not know when you are making or losing money until it is embarrassingly too late.

11.

They allow other people's ideas to affect their decisions unreasonably. There will always be people who do not believe in your way, or who are pessimistic, who try to pull you down, or whatever.

And they will sometimes be your closest friends and family. You cannot change that - they have a right to be who they are.

It is OK.

Allow them their thoughts, do not judge them for that, but do not feel obligated to accept their thoughts of follow their way.

Do not allow other people, now or from the past, unreasonably affect your decisions. Allow them their way, and you live your way.

12.

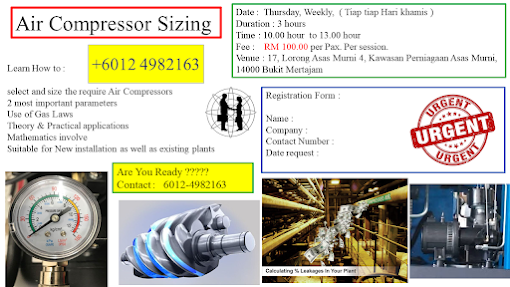

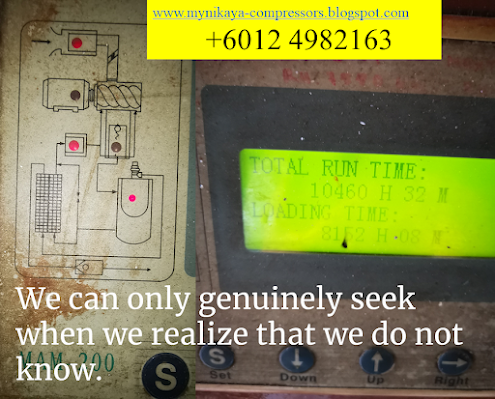

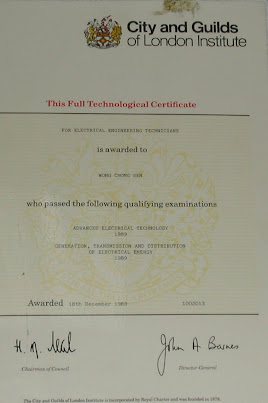

They do not get quality coaching. This is extremely important! Coaching is simply getting mentored by someone who has succeeded wildly in the area of your interest. Get coaching! Our education system hardly equips us for real life, so do not assume that because you went to college you are properly equipped.

Hardly.

You need to keep learning.

The most successful people attend seminars, read books, join mastermind groups and clubs, find mentors, network, and even hire expensive personal coaches to make sure they succeed.

How many of these reasons can you identify with?

Well, now that you see the reasons, you now can look at yourself and make sure that you don't follow ways that are known to not lead to wealth.

Follow what works and it will work.

And do not forget to enjoy yourself along the way.